If you’ve ever checked your credit score using free online tools like Credit Karma or Capital One’s CreditWise, chances are you’ve seen your VantageScore rather than your FICO score. But what does that mean?

Welcome to Day 3 of March Money Moves: Elevate Your Credit in 30 Days! Today, we’re diving into a key credit scoring model that many people see but don’t fully understand—VantageScore.

What is a VantageScore?

VantageScore was introduced in 2006 as an alternative to the FICO scoring model. It was developed by the three major credit bureaus—Experian, Equifax, and TransUnion—to provide a more consistent way of measuring creditworthiness.

Just like FICO scores, VantageScores range from 300 to 850, with higher scores indicating better credit health. However, the way they calculate your score differs from FICO, leading to slight variations when you check your credit across different platforms.

VantageScore Ranges

Knowing your score range can help you understand where you stand:

- 300-499 – Very Poor

- 500-600 – Poor

- 601-660 – Fair

- 661-780 – Good

- 781-850 – Excellent

What Factors Affect Your VantageScore?

Your VantageScore is based on multiple factors, just like your FICO score. However, the weight of each factor is slightly different.

Key Factors That Impact Your VantageScore:

- Payment History (41%) – The most significant factor; late payments will negatively impact your score.

- Credit Utilization (20%) – How much credit you’re using compared to your total available credit.

- Credit Age & Mix (20%) – A longer credit history and a mix of credit types (loans, credit cards) help boost your score.

- Recent Credit (11%) – Opening multiple new credit accounts in a short period can lower your score.

- Available Credit (6%) – Having more available credit can slightly improve your score.

What’s NOT Included in Your VantageScore?

While some people believe income or job history impacts their credit, these factors are not included in your score calculation:

- Your income

- Employment status

- Bank account balances

- Soft credit inquiries (checking your own credit report)

- Utility and rent payments (unless reported by a third-party service like Experian Boost)

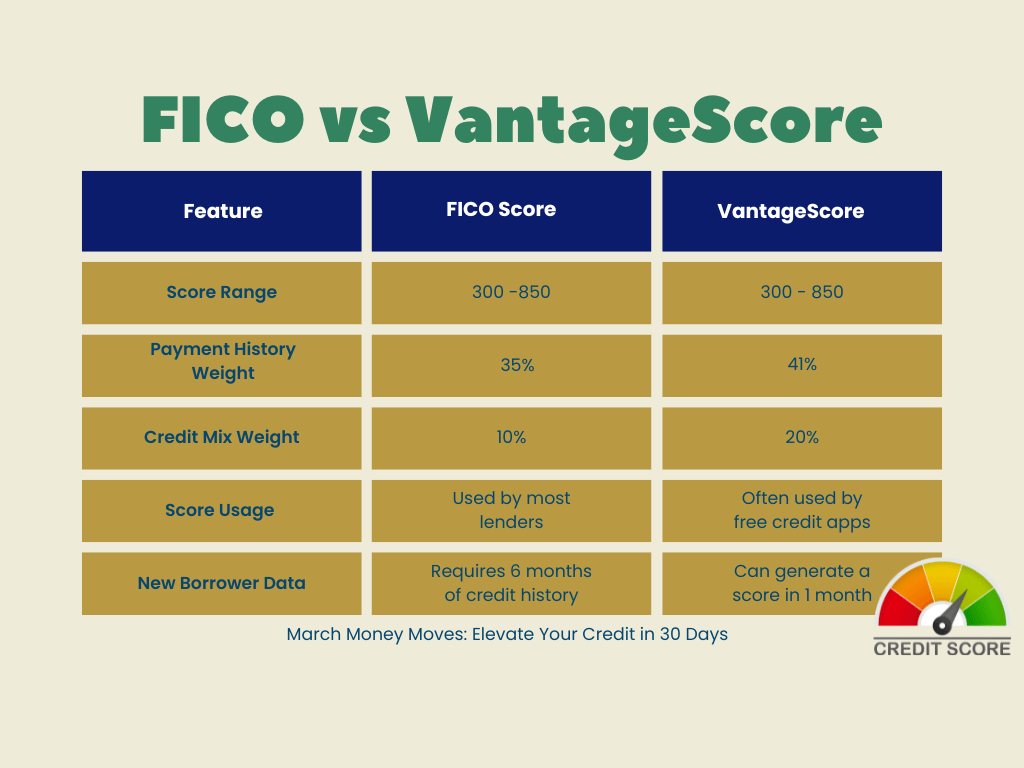

How Does VantageScore Compare to FICO?

While both scores serve the same purpose, they are calculated differently.

Understanding your VantageScore is an essential step in managing your credit. While most major lenders use FICO scores, your VantageScore still provides a valuable snapshot of your financial health.

Your challenge for today: Check which score you’re seeing when you monitor your credit. Is it FICO or Vantage? Let us know in the comments!

Stay tuned for tomorrow’s post, where we’ll discuss free credit scores—where to find them and what to watch out for!