March Money Moves is all about elevating your credit in 30 days, and today we’re diving into a key part of your credit health—your FICO score. This number plays a massive role in your ability to secure loans, get approved for credit cards, and even purchase a home.

Let’s break down what a FICO score is, how it’s calculated, and what you can do to improve it.

What is a FICO Score?

FICO, which stands for Fair Isaac Corporation, is the company that created the most widely used credit scoring model. Your FICO score is a three-digit number ranging from 300 to 850, which helps lenders determine how risky it is to lend you money. The higher your score, the better your creditworthiness.

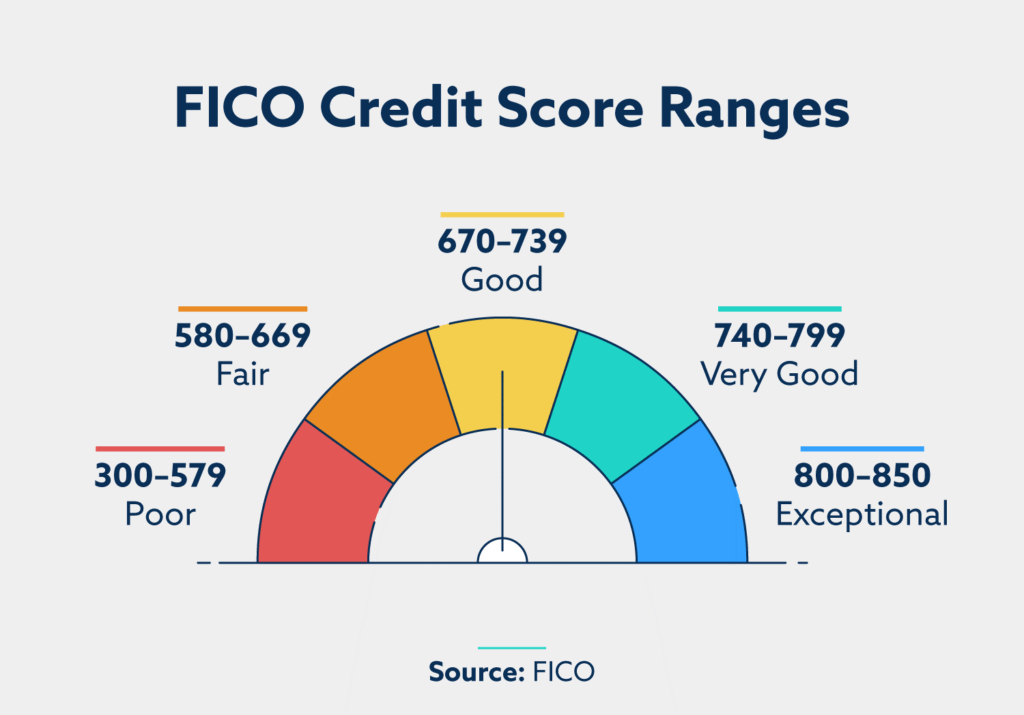

FICO Score Ranges

Understanding where you stand can help you set realistic goals for improvement.

- 300-579 – Poor (Needs significant improvement)

- 580-669 – Fair (Below average, but still workable)

- 670-739 – Good (Many lenders approve loans in this range)

- 740-799 – Very Good (Lower interest rates and better credit opportunities)

- 800-850 – Exceptional (Top-tier borrowers with the best terms)

How is Your FICO Score Calculated?

Your FICO score is based on five key factors:

- Payment History (35%) – This is the most significant factor. On-time payments improve your score, while late payments, defaults, and bankruptcies can damage it.

- Amounts Owed (30%) – This refers to your credit utilization ratio, or how much credit you’re using compared to your limits. Keeping your utilization below 30% is best.

- Length of Credit History (15%) – The longer your credit accounts have been open, the better it is for your score.

- Credit Mix (10%) – A mix of credit cards, loans, and mortgages can positively impact your score.

- New Credit (10%) – Opening too many new accounts in a short period can temporarily lower your score.

What’s NOT Included in Your FICO Score?

Some people think factors like income or employment history affect their credit score, but they don’t. Here’s what FICO doesn’t consider:

- Your income or bank account balances

- Employment history

- Age or marital status

- Utility bills (unless they go into collections)

- Soft inquiries (like checking your own credit score)

Your challenge for today is to check where your FICO score stands

Many banks, credit card issuers, and financial institutions offer free access to your FICO score. Some common ways to check include:

- Logging into your bank or credit card account

- Using financial apps like Credit Karma or Experian

- Paying for a report directly from myFICO.com

Final Thoughts

Knowing your FICO score is the first step toward financial empowerment. Whether you’re planning to buy a home or simply want better loan terms, maintaining a strong FICO score can open doors to better financial opportunities.

In our next blog post, we’ll discuss Vantage Scores—what they are and how they differ from FICO scores. Stay tuned!

FTC Disclaimer: This is not a sponsored video or article. All opinions are genuinely my own. This post also contains affiliate links and I earn a small commission if you make a purchase after clicking on my links. It does not cost you any extra. Thank you for your continued support to keep the Bri Callis Blog going!