Buying your first home is an exciting and transformative experience, but it can also feel overwhelming. As 2025 approaches, it’s the perfect time to prepare for homeownership by equipping yourself with the right knowledge.

Whether you’re just starting to save or are actively searching for your dream home, these 25 tips will help guide you through the process smoothly and confidently.

1. Check Your Credit Score Early

Your credit score significantly impacts the mortgage rates you’re offered. Pull your credit report as early as possible, and if needed, take steps to improve it by paying down debts and avoiding late payments. The higher your score, the lower your interest rate.

2. Set a Realistic Budget

While it’s tempting to go for the most expensive home you qualify for, stick to a budget that ensures you’ll be comfortable with your monthly payments. Factor in taxes, insurance, and maintenance costs. Aim to keep your total housing expenses under 28% of your monthly income.

3. Save for a Down Payment

The more you can put down upfront, the better. While some programs allow as little as 3% down, a larger down payment can reduce your mortgage and monthly payments. Down payment assistance programs can also help if you’re struggling to save.

4. Don’t Forget Closing Costs

Closing costs can be between 2-5% of the home’s purchase price. Make sure you budget for these expenses, which can include loan origination fees, appraisal fees, and title insurance.

5. Get Pre-Approved

A pre-approval letter from a lender shows sellers that you are serious and financially ready to buy. It also clarifies your budget and can give you a competitive edge in a bidding war.

6. Avoid New Debt Before Closing

Taking out new loans or credit cards during the homebuying process can affect your credit score and jeopardize your mortgage approval. Wait until after closing to make significant purchases.

7. Research First-Time Homebuyer Programs

Many states and local governments offer programs that assist with down payments and closing costs. Research what’s available in your area to take advantage of these resources.

8. Work with an Experienced Realtor

A knowledgeable realtor can make the homebuying process much easier. Choose someone who understands the local market and can guide you from search to closing.

9. Prioritize Needs Over Wants

Identify what you truly need in a home – like the number of bedrooms or proximity to work – versus features that would be nice but aren’t essential. This helps you stay focused and within budget.

10. Always Get a Home Inspection

A professional home inspection can uncover hidden issues that could cost you thousands. Never skip this step, even if the home appears to be in great condition.

11. Research Neighborhoods Thoroughly

Visit neighborhoods at different times of day to get a sense of the community. Look into local schools, commute times, and amenities.

12. Think About Long-Term Value

Consider how the home will fit your needs in the next 5-10 years. Look at resale potential, school districts, and upcoming developments in the area.

13. Be Ready to Act Quickly

In competitive markets, homes can sell fast. If you find a property you love, don’t wait too long to make an offer. Have your pre-approval and documents ready.

14. Clarify What’s Included in the Sale

Before signing the contract, make sure you understand what comes with the house – such as appliances, fixtures, or landscaping features. This prevents misunderstandings down the road.

15. Understand HOA Fees

If the home is part of a homeowners association (HOA), research the fees and what they cover. HOA fees can add significant costs to your monthly expenses.

16. Know Your Property Tax Obligations

Property taxes vary by location and can increase over time. Understand how much you’ll need to pay annually and how that fits into your budget.

17. Plan for Maintenance and Repairs

Owning a home comes with maintenance responsibilities. Set aside funds for future repairs and upkeep to avoid financial stress.

18. Lock in Your Interest Rate

Interest rates can fluctuate during the homebuying process. Once you’re comfortable with your loan terms, lock in your rate to protect yourself from increases.

19. Don’t Stretch Your Budget to the Limit

Leave room in your budget for unexpected expenses, emergencies, or lifestyle changes. Just because you qualify for a large loan doesn’t mean you should use it all.

20. Be Patient and Persistent

Finding the right home can take time. Don’t rush the process or settle for something that doesn’t meet your core needs. The right home is worth the wait.

21. Ask Questions

Don’t hesitate to ask your realtor, lender, or inspector about anything you don’t understand. The more informed you are, the better decisions you’ll make.

22. Read All Documents Carefully

Before signing, thoroughly read through all loan agreements and contracts. Understand the terms, fees, and conditions. If anything is unclear, seek clarification.

23. Get Homeowners Insurance Early

Homeowners insurance protects your investment from day one. Shop around for coverage that fits your needs and budget.

24. Plan for Moving Expenses

Factor in the costs of moving, setting up utilities, and buying new furniture. These expenses can add up quickly after closing.

25. Enjoy the Process!

Buying your first home is an exciting journey. Celebrate your milestones, stay positive, and enjoy the process of becoming a homeowner.

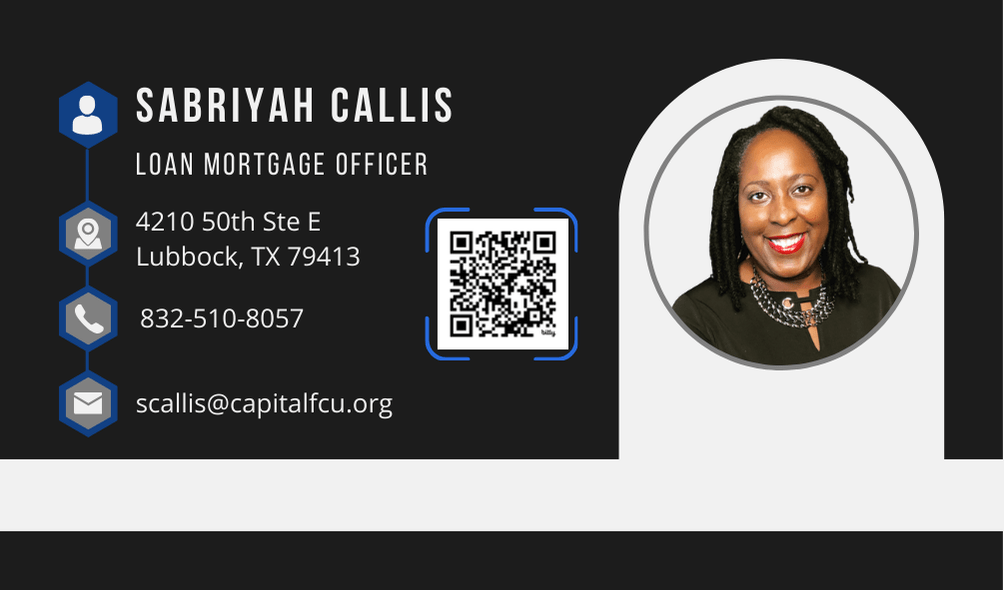

By following these 25 tips, you’ll be well on your way to making smart, informed decisions as you purchase your first home in 2025. If you’re ready to take the next step or have questions about the home-buying process, I’m here to help! Contact me today, and let’s get started on your journey to homeownership.

Sabriyah Callis | NMLS 2537498 | Equal Housing Lender

FTC Disclaimer: This is not a sponsored video or article. All opinions are genuinely my own. This post also contains affiliate links and I earn a small commission if you make a purchase after clicking on my links. It does not cost you any extra. Thank you for your continued support to keep the Bri Callis Blog going!