When you’re ready to buy a home, one of the most important steps is getting pre-approved for a mortgage. But before you can get the green light from a lender, you’ll need to gather the right paperwork.

The thought of organizing documents may seem overwhelming, but knowing exactly what to prepare can save you time, reduce stress, and make the process smoother. In this guide, we’ll break down the essential paperwork you need when applying for a home loan.

Why Do Lenders Require Paperwork?

Before diving into the specifics, let’s look at the bigger picture. Why do lenders need so much information?

The short answer: They’re verifying your financial stability. Lenders want to ensure you can afford your mortgage payments by reviewing your income, debts, assets, and credit history. This documentation gives them a clear view of your financial situation and helps them decide:

- If you qualify for a loan.

- How much they’re willing to lend you.

Now, let’s explore the key categories of documents you’ll need.

1. Proof of Identity

First, you need to prove you are who you say you are. This is a straightforward step but absolutely essential. Lenders typically require:

- A government-issued photo ID (e.g., driver’s license or passport).

- Your Social Security card or ITIN documentation (if applicable).

2. Proof of Income

Your income is a critical factor in determining how much home you can afford. Lenders will need documents to verify your earnings and job stability, such as:

- Pay Stubs: Covering the last 30 days if you’re a W-2 employee.

- W-2 Forms: From the last 2 years to show consistency in your earnings.

- Tax Returns: Especially important if you’re self-employed or earn income from multiple sources.

- Bank Statements: These help confirm direct deposits and overall financial stability.

- Employment Verification Letter: Sometimes, lenders request a letter from your employer to confirm your job status and income.

3. Credit Documentation

Your credit score plays a major role in the home loan process, but lenders will pull this directly from the credit bureaus. However, you should be prepared to explain any financial events, such as:

- Bankruptcies.

- Foreclosures.

- Late payments.

If these apply to you, the lender may ask for supporting documents to explain your situation.

4. Asset Information

To ensure you have the funds for your down payment and closing costs, you’ll need to provide:

Retirement Account Statements: If you’re withdrawing funds from a 401(k) or IRA, provide documentation of the withdrawal or loan.. Asset Information

Bank Statements: Covering the past 2-3 months for all accounts.

Gift Letters: If a family member or friend is contributing to your down payment, they’ll need to confirm that the money is a gift, not a loan.

5. Debt Verification

Lenders will also review your debts to calculate your debt-to-income (DTI) ratio, which is a key factor in determining loan eligibility. You’ll need:

- Loan Statements: For auto loans, student loans, or personal loans.

- Credit Card Statements: To verify balances and minimum payments.

- Child Support or Alimony Documentation: If applicable, these obligations will also be factored into your DTI ratio.

Tips for Staying Organized

- Create a Checklist: Use this guide to create a personalized checklist of the documents you need.

- Keep Digital and Physical Copies: Scan your documents and save them in a secure folder on your computer or cloud storage for easy access.

- Double-Check for Accuracy: Make sure your documents are up to date and match the information you provide on your application.

- Communicate with Your Lender: If you’re unsure about a document or need help gathering certain items, don’t hesitate to ask your lender for guidance.

Common Questions About Home Loan Documents

Q: What if I’m self-employed?

If you’re self-employed, you’ll need to provide additional documentation to verify your income, such as:

- Two years of personal and business tax returns.

- A year-to-date profit and loss statement.

- 1099 forms for independent contractors.

Q: Do I need all of these documents before getting pre-approved?

While not every document may be required for pre-approval, having as much prepared as possible will help the process go smoothly.

Q: Can I apply without a steady income?

If your income fluctuates or you’re in between jobs, your lender may still work with you, but be prepared to provide additional documentation to explain your situation.

Applying for a home loan doesn’t have to be stressful if you’re well-prepared. By gathering the required documents and staying organized, you’ll make the process easier for yourself and your lender.

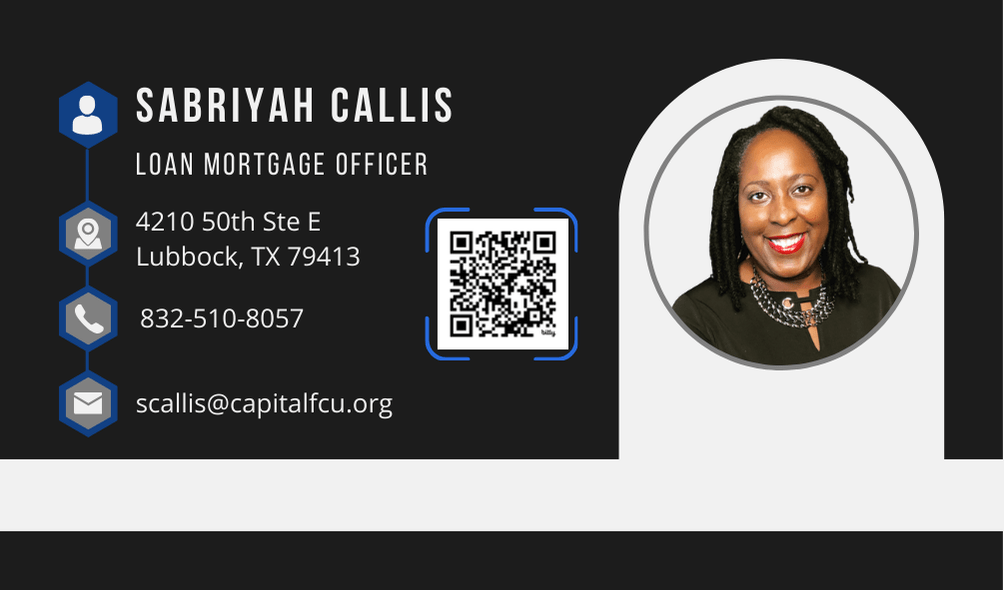

If you’re ready to take the next step or have questions about the home-buying process, I’m here to help! Contact me today, and let’s get started on your journey to homeownership.

Sabriyah Callis | NMLS 2537498 | Equal Housing Lender

FTC Disclaimer: This is not a sponsored video or article. All opinions are genuinely my own. This post also contains affiliate links and I earn a small commission if you make a purchase after clicking on my links. It does not cost you any extra. Thank you for your continued support to keep the Bri Callis Blog going!