Pre-qualification and pre-approval are terms commonly used in the context of obtaining a mortgage or a loan, and they refer to different stages in the loan application process.

Pre-Qualification:

- Definition: Pre-qualification is a preliminary assessment of a borrower’s financial situation to determine the amount they might be eligible to borrow. It is typically based on information provided by the borrower, such as income, assets, and debts.

- Process: To get pre-qualified, a borrower typically provides basic financial information to a lender or mortgage broker. This information is used to estimate the loan amount the borrower might qualify for.

- Verification: Pre-qualification is often done without extensive verification or documentation. It’s more of an informal, initial step in the process.

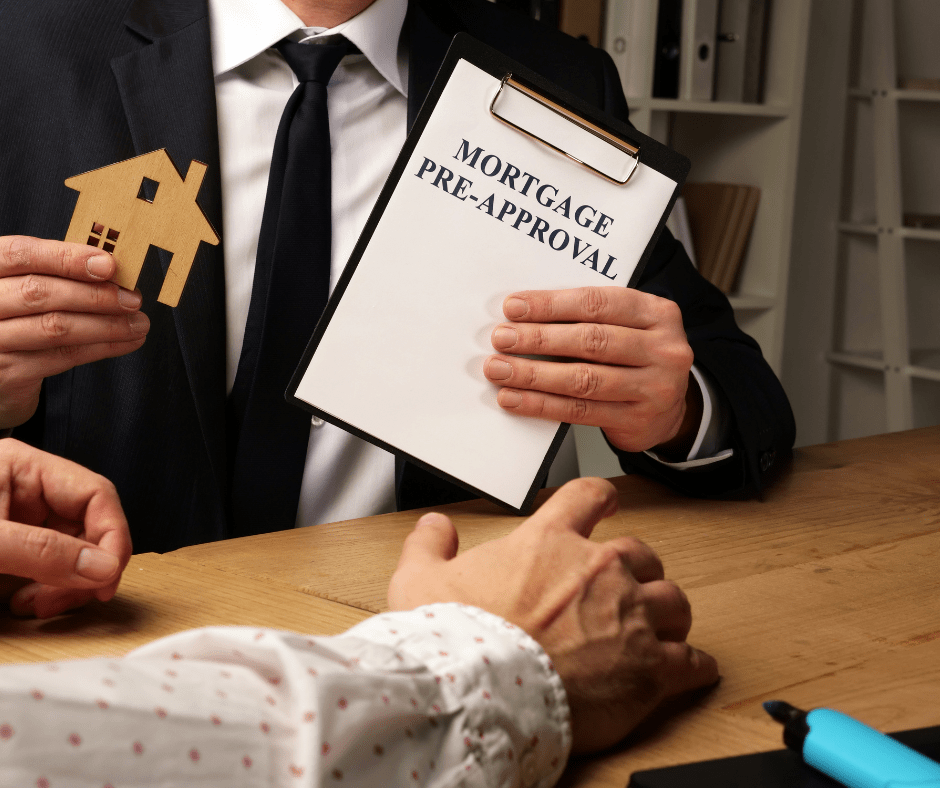

Pre-Approval:

- Definition: Pre-approval is a more in-depth and formal process where a lender thoroughly evaluates a borrower’s financial information, including income, credit history, and debt, to determine the maximum loan amount for which the borrower is approved.

- Process: To get pre-approved, a borrower usually completes a mortgage application and provides supporting documentation, such as pay stubs, tax returns, and bank statements. The lender then reviews this information and issues a pre-approval letter.

- Verification: Pre-approval involves a more thorough verification process compared to pre-qualification. The lender checks the borrower’s creditworthiness and may verify the information provided.

Key Differences:

- Level of Confidence: Pre-approval is a more robust and reliable indication of a borrower’s ability to secure a loan because it involves a more thorough evaluation and verification process.

- Documentation: Pre-qualification is often based on self-reported information and may not require extensive documentation. Pre-approval, on the other hand, involves the submission of detailed financial documents.

- Usefulness in the Homebuying Process: While pre-qualification gives a rough estimate of affordability, pre-approval is more meaningful when making an offer on a home. Sellers tend to view pre-approved buyers as more serious and financially qualified.

Pre-qualification provides a quick estimate of borrowing capacity based on self-reported information, while pre-approval involves a more rigorous evaluation process with document verification, offering a more reliable assessment of a borrower’s eligibility for a loan.

Sabriyah Callis | NMLS #2537498 | Equal Housing Lender

FTC Disclaimer: This is not a sponsored video or article. All opinions are genuinely my own. This post also contains affiliate links and I earn a small commission if you make a purchase after clicking on my links. It does not cost you any extra. Thank you for your continued support to keep the Bri Callis Blog going!